Venture capital and incubators

Berlin is the leader in the number of financing round and one of the most important target area for foreign investors.

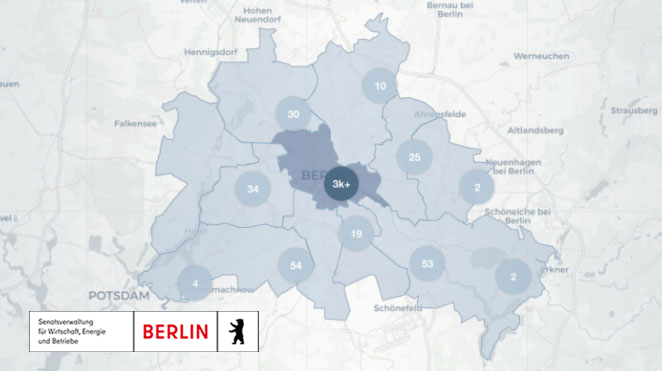

Of the seven billion euros in venture capital that were invested in German startups in 2024, 31 percent, 2.2 billion euros, went to startups in Berlin. This makes Berlin one of the most important region for tech investments in Germany. Although the number of financing rounds has fallen nationwide, Berlin startups were able to claim one in three financing rounds with 256 financing rounds.

Local business angels, company owned and university related incubators, accelerators as well as national and international venture capital investors support Berlin’s young entrepreneurs in the foundation phase. Numerous successful startups have emerged that way, e.g. Zalando, Mister Spex, N26, SoundCloud, Wooga oder Delivery Hero.